Fiscal Registration

How do I get a tax number quickly?

Every company or entrepreneur in Germany needs a tax number. We know the stumbling blocks in the fiscal questionnaire and how to answer the complex questions correctly. For you, it means that a lot of time and nerves are saved in the foundation process when you ask us to take care of the fiscal registration. We ensure that you receive your tax number as quickly as possible. If you issue invoices without a tax number or VAT ID Number, you still owe VAT but your business partner cannot deduct input VAT.

Fiscal registration (tax registration questionnaire)

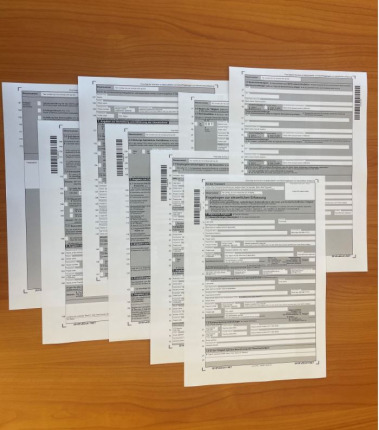

The tax number is applied for at the competent tax office by submitting the fiscal registration questionnaire. The questionnaire is very extensive, consisting of eight pages. In addition, some documents have to be added, such as the articles of association and an extract from the commercial register. If these are forgotten, the tax office will have queries and granting of the tax number will be delayed. Once all the documents have been received by the tax office, it can take weeks or even months before the documents are processed and the tax number is issued.

8 pages that have it all – the fiscal registration questionnaire

VAT registration/VAT ID number

Companies that have received a tax number are automatically registered for VAT purposes in Germany. If you participate in intra-Community trade, you will also receive a VAT identification number (UST-ID No.) upon application.

Foreign shareholders/companies

If the company has foreign shareholders, additional documents must be submitted. These include a rental agreement for a workplace/office and the employment contract of the managing director. In the case of foreign shareholders, it can happen that an auditor from the tax office wants to see the office and have the business model explained to him by the manager.

Foreign companies that have neither a registered office nor a management or permanent establishment in Germany, but have VAT-taxable turnover in Germany, must register in Germany for VAT purposes only. We will be happy to advise you on whether you need to register for (turnover) tax purposes in Germany and take care of the registration.

Trade registration

In addition to the fiscal registration, the business must be registered with the city or municipal administration in which the business or permanent establishment is opened. For this purpose, a trade registration form must be completed and submitted to the competent municipality. We will be happy to do this for you as well. Trade Registration and issuing a trade licence are subjects to a municipal fee. This licence is required, for example, for the registration of company cars or for company cards at supermarkets.