International taxation for companies: Benefitax

Our expertise in international taxation

International taxation is the focus of our advisory activities in taxation. Generally, a great deal of money is involved in international taxation. We help you avoid expensive mistakes.

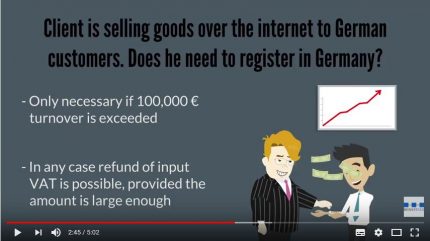

Please find here our explainer video about VAT and VAT registration in Germany including online trading

We support our clients in planning and utilizing their tax benefits. Our services are especially appreciated when someone is confronted with the following:

- profit estimations of a specialized auditor for cross-border transactions in a tax field audit or

- filing tax returns for previous years and paying retroactive taxes

- non-refund of the VAT paid incorrectly to tax authorities or accounted for in the outgoing invoices.

The proverb: “If you think compliance is expensive, try to be non-compliant” is apt here.

We offer the following services in international taxation for companies

International taxation for companies

Transfer pricing

Individual business entities in various countries exchange services and supplies with each other within internationally active companies and groups and pay compensation for these, in the form of transfer pricing. If these are not correctly calculated or documented, high penalties and additional payments can be imposed at the time of a tax field audit. We help companies calculate an appropriate transfer price and prepare the transfer pricing documentation.

VAT

VAT regulations in the EU are considered to be complicated and are subject to constant changes. It is easy to make mistakes, which can prove to be expensive in case of cross border services and supplies, triangular trade or consignment warehouses. Companies, which account for VAT incorrectly, owe it to the tax authorities although the receiving company cannot get any input tax refunded. Companies which fail to account for VAT also owe it. If someone does business with EU companies without checking their VAT ID number, they run the risk of assuming the liability for VAT. In our expert opinions on VAT, we check single transactions with regard to VAT or show you the correct handling for all your transactions with regard to VAT. More about international VAT and expert opinions on VAT.

International assignments of employees

When employees work for a limited period of time for another group company in another country, this is referred to as an international assignment. Complex issues related to wage tax and social security law must be clarified and calculations must be made before the international assignment starts. Specialists from both involved countries should be consulted. Our experts gladly help you and work out possible solutions and any issues to bee considered when sending employees on international assignments.

Intra-group tax planning, restructuring, start-ups and acquisitions

How can companies with international operations lower their effective tax rate? How can the risks be minimized at the time of tax field audits? What impact do the BEPS action plans have on your company? How to avoid the disclosure and taxation of hidden reserves or real estate transfer tax in case of restructuring? What should I consider at the time of start-up? Which acquisition and which transaction structure is the most beneficial in case of company acquisitions? The experts at Benefitax deal with many such questions and other queries during tax planning.

Expansion from or into a foreign country

Are you planning to break into the German market? Or as a German company, do you want to sell your products abroad or offer your services there? Whether it is about VAT-related issues, the registration of employees abroad, setting up a branch office, foundation of a subsidiary or acquisition of a company in another country, Benefitax can help you with everything. Talk to us for our services for the set-up of subsidiaries or branch offices.